Part II

UNCLOS and Economic Rights Coastal States

The United Nations Convention on the Law of the Sea (UNCLOS) grants special rights to the coastal states with regards to exploration and use of marine resources, including energy production in the area in its jurisdiction at times termed as exclusive economic zone.

Economic Control of Waters

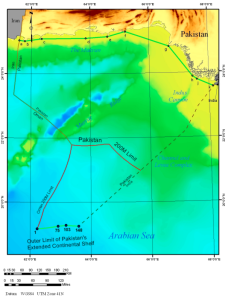

Article 76(4) to (6) of the UNCLOS prescribes a complicated formula for claiming such an extension. The claimant state has to present legal and scientific core material for its claim before a 21 strong member commission of experts. The evidence is invariably supported by maps to establish that the claimed continental shelf is an extension of its territory and conforms to the description contained in the Law of Sea Treaty of 1982. According to the provisions contained in UNCLOS coastal countries are allowed economic control of the waters and seabed up to 200 nm from their shores. Further international treaty allows countries to claim an extended continental shelf stretching up to 350 nm from the baselines of its territorial sea if the applicant state can establish that the claimed area was a natural extension of their contiguous land territory.

Pakistan’s Continental Shelf

Credit;Pakistan Hydrographic

Credit;Pakistan Hydrographic

Pakistan approached UNCLCS in the year 2009. Prior to approaching the UNCLOS elaborate research was undertaken by the relevant authorities .Subsequently a sub-commission of the UNCLOS on ” Limits of Continental Shelf ” reviewed and evaluated Pakistan’s case and accepted its claim for extension of its continental shelf limits . As a result Pakistan’s sea limits was extended from 200 nautical miles to 350 nautical miles . This acceptance, in the year 2015 , was despite certain of the claimed territory partially overlying an Omani claim .It is believed in maritime circles that this acquiescence was amicably agreed pursuant to negotiations.

Expansion of Offshore Territory and Economic Gains

Following the acceptance of the claim, Pakistan’s offshore territory of 240,000 sqkm expanded by another 50,000 sqkm as a result it has been granted inherent economic rights to exploit the natural resources contained in the expanded maritime territory. In the past Pakistan has been slow to explore the hydrocarbon and mineral potential in its continental shelf and it is expected that the pace of exploration , despite being capital intensive , would accelerate in order to meet its increasing energy needs and essential mineral requirements. Pakistan’s Exploration and Production sector annually produces around 3,200 mmcfd of natural gas along with 70,000 bbls of indigenous oil and this output meets only 35 % of the country’s primary energy supply.

Offshore Exploration of Sedimentary Basin

Pakistan’s sedimentary basin extend over 827,000 sq kms including 6 onshore and 2 offshore basins which remain largely under explored apparently due to lack of resources , technology, uncompetitive fiscal regime and regulatory regime post-18th amendments in the Constitution of the Islamic Republic of Pakistan 1973 . Around 20 wells have been drilled since 1947 . Offshore deepwater development and exploration is markedly different from onshore exploration as it is significantly capital intensive , expensive, high risk and long term. Cost enhances for offshore exploration , development and production including well depth, water depth, reservoir pressure and temperature, field size, shore distance, availability of infrastructure and logging and seismic services .The Indus Offshore Basin exhibits an extremely thick sediment deposition of up to 10 km which may be manifested in high pressure and high temperature formations increasing the cost of exploring upon venturing into deeper waters .

Capital Cost in Offshore Drilling

Currently deepwater lifecycle economics vary from $ 50 to $ 60/bbl price for breakeven and timelines from discovery to first oil or gas production can range from 6 years to 10 years . Contracts for hiring of offshore drilling rigs factor in the number of days and the cost of a single exploration can range from $ 60 m to $ 200 m considering as drill-ships or semi-submersibles are contracted for deep waters with average running rates at approximately $380,000 daily or even upto $450,000 per day a A commercial discovery entails more expenditure such as field development plan requiring a platform, pipelines and subsea systems with a minimum investment of $ 2 bn depending on production capacity, drilling facility and length of pipelines .Capital expenditure from discovery to production vary from $ 3.5 bn to more than $ 10 bn due to a lack of existing infrastructure in offshore basins. The density of exploration grid is only 16×16 km and 14 wells have been drilled in the Offshore Indus Basin, including 3 wells located in the deep-water area, namely Anne 1x, Pak-G2 1 and Kekra 1. The remaining 11 wells have been drilled in the shallow shelf and the quality of reservoirs has been poor in the geological and commercial sense.

Oil and gas drilling results of the offshore / Arabian Sea are depicted below ;

| No. | Well name | Operator | Year | TD/m | Result and reasons |

| 1 | Dabbo Creek 1 | Sun | 1963 | 4354 | Drill off structure |

| 2 | Patiani Creek 1 | Sun | 1964 | 2659 | Drill off structure |

| 3 | Korangi Creek 1 | Sun | 1964 | 4140 | Possible seal failure |

| 4 | Indus Marine A-1 | Wintershall | 1972 | 2841 | Poor reservoir quality |

| 5 | Indus Marine B-1 | Wintershall | 1972 | 3804 | Mechanical failure |

| 6 | Indus Marine C-1 | Wintershall | 1975 | 1942 | High formation pressure |

| 7 | Jal Pari 1A | Marathon | 1976 | 2007 | High formation pressure |

| 8 | Karachi South A-1 | Husky | 1978 | 3353 | Poor reservoir quality |

| 9 | Pakcan 1 | OGDC | 1985 | 3701 | Edge of sand body |

| 10 | Sadaf 1 | Occidental | 1989 | 3980 | Lack of charge |

| 11 | Shaikh Nadin 1 | Canterbury | 1992 | 1679 | Gas show |

| 12 | Pasni 1 | OPC | 1999 | 3569 | Reservoir not encountered |

| 13 | Gwadar 1 | OPC | 2000 | 3810 | Reservoir not encountered |

| 14 | Pak-G2 1 | Total | 2004 | 4750 | Lack of charge |

| 15 | Pasni X-2 | PPL | 2005 | 4000 | Reservoir not encountered |

| 16 | Anne 1x | Shell | 2007 | 3268 | Reservoir not encountered |

| 17 | Shark 1 | Eni | 2010 | 3503 | Lack of charge |

| 18 | Kekra 1 | Eni | 2019 | 5693 | Lack of charge |

Pakistan’s Energy Security Remains Perilous

The energy sector of Pakistan is perpetually confronted by a severe cash flow crisis as the outstanding receivables from Exploration and Production (E&P) companies owed by state-owned gas utilities have escalated to almost PKR 1,500 billion including $ 600 million payable to foreign companies. In the last decade no new international upstream company has invested in any block or opportunity on offer whereas some international E&P companies have wound up their operations . The E&P sector is drastically slashing exploration and development activities as in the past one year out of the planned 23 exploration wells only 9 were spud. More alarming is that only 19 out of the available 42 rigs are operational accompanied by a substantial reduction in seismic activities. It is distressing to note that development wells are being put on hold as companies are reluctant to invest and bring additional gas volumes to market which is leading to costly energy imports including LNG. Any amendment to the Exploration and Production (E&P) Policy 2012 should factor in offshore production as well .

Author ; Nadir Mumtaz

Trademark Blue Economy IPO-PK

Credit /Sources ;

https://hydrography.paknavy.gov.pk/achievements/

https://doi.org/10.31035/cg2020051 , https://www.sciencedirect.com/science/article/pii/S209651922030207X

syed mustafa amjad , https://www.dawn.com/news/1267395

Leave A Comment