Economic & Commercial Maritime Energy Rivalry – Urals Oil

Russia’s Urals oil is used as a reference brand for pricing of export oil mixture with the other main reference brand being Brent. It comprises a mix of heavy sour oil of Urals and the Volga Region blended with light oil of Western Siberia Urals crude exported from the Baltic and Black Sea ports involving long shipping voyages to China and India . Russia produces four crude oils namely ESPO, Urals, Sokol and Sakhalin with ESPO and Sakhalin considered suitable for refining in Pakistan’s refineries by blending it with the crude oil imported from the UAE and Saudi Arabia. Pakistan has six operational oil refineries with different refining configurations.In any case local refineries meet 20 % of Pakistan’s petroleum requirements with the remaining 80 % refined by importing crude oil subject to each crude consignment being adjusted one time with technical suitability of the crude grade , refinery configuration and yield in terms of percentage of volume. PARCO can pioneer such a venture. Pakistan and Saudi Arabia and U.A.E have long term crude supply contracts and there has to be an upper cap on oil pricing. These producers have the option to offer Pakistan lower priced oil. Regarding labour in the Kingdom of Saudi Arabia and U.A.E India also has a sizeable labour , technical and executive presence .In 1998 Saudi Arabia offered oil on deferred payments and later converted into grant.

Public sector & private refineries caught napping

PARCO is a Mid Country Refinery with a public sector strategic shareholding as well as shareholding of UAE. Pakistan State Oil , which has the market share of around 65 % in the domestic market, has a strategic shareholding of the public sector and can place order for Russian crude. PARCO configuration is more advanced and Russian crude can reach and initially be stored at Karachi Port Keamari storage whereas other refineries are of older configuration and have not upgraded therefore remain inefficient in any case . PARCO can blend Russian crude with Saudi and U.A.E crude or can exclusively refine Russian crude . No sanctions on Pakistani refineries and even if sanctions are imposed they will be imposed on India and China as well and existing cargoes are exempt from sanctions. PARCO refinery can blend or process any crude and in case of any additional cost, being public sector , can absorb the additional initial costs of refining Russian crude out of state revenue share otherwise it should be privatized .

Regional Scenario

Russian oil imports account for the second largest source for India after imports from Iraq. Indian contracts for Urals crude for March to June and projections for deliveries in July and August (around 66.5 million barrels cumulative) amount to more than the quantity purchased during all of 2021 ( procured 4.8 million metric tonnes of discounted Russian oil ) . India is importing Urals oil and compared to Brent crude ,being the global benchmark, discount being favorable at around USD 30 per barrel. Urals oil from Russia currently trades at about USD 95 a barrel, while the global benchmark Brent crude is above USD 119 a barrel. Earlier Russian Ural crude was uneconomical due to high freight costs. India is taking advantage of increased global shipping costs and trying to dominate Russian trade to other South Asian countries including Iran and Oman .

Sanctions

Indian refineries are facing a daunting task to finance Russian purchases on account of sanctions on Russian banks however, no secondary sanctions apply on countries doing business with Russia. India’s dependence on West Asian oil gives Indian refiners improved bargaining strength with Saudi Arabia oil pricing besides strategically improving its energy security.

Oil of Russian origin is banned from entering the European Union (EU) however Europe has no rules in place on the supply chain for imported gas, diesel and other refined products long as they come from unsanctioned refiners . India is reaping profits on export of Russian origin oil and exploiting this “refining loophole” and its significantly large refineries are engaged in importing Russian feedstocks. These refiners import quasi-sanctioned oil cargoes aboard “dark fleet” tankers then export legitimate clean refined products. As reported by the Center for the Study of Democracy the EU imported around 13% of its seaborne cargoes of diesel and jet fuel , valued at almost $ 5 billion, from India this year. Specifically in the first three quarters of 2024 exports to the EU from the Jamnagar, Vadinar and new Mangalore refinery were largely based on Russian feedstock and recently Russian energy producers are demanding better prices as Russian energy producers skills are improving at circumventing the G7 “price cap” . As a long term measure the European Commission seeks to significantly reduce Europe’s dependence on Russian liquefied natural gas and nuclear fuel. While the EU has curtailed its consumption of Russian energy there is still a long way to go, particularly with LNG , as Europe continues to derive about 15 % of its natural gas supply from Russia. In its latest round of sanctions on the Russian tanker fleet the European Commission listed one of Sovcomflot’s 15 icebreaking LNG carriers being key enablers for gas exports from Russia’s Yamal LNG plant to Europe while the other vessels remain unsanctioned and continue to call at ports in Europe.

Russia India Oil Trade Increases Post Ukraine War

Bilateral trade between India and Russia hit a new high, of $ 18.2 bn by value, from April through to August 2022, versus $ 13.1bn reported for the whole of fiscal year 2021-22. China and India remain choice destinations for Russian crudes comprising 58% of all seaborne Russian crude exports in October 2022. Russia has emerged as the leading supplier of crude to India .Even refineries in China prefer lower priced Russian crude over Brazilian oil which is a long haul from Brazil . India is witnessing a 100 % year on year surge in Russian import trade values post Ukraine war of 2022.

Russian Companies & Commercial Subterfuge

International traders namely Vitol and Trafigura had to disengage from Russia’s oil trade on account of US sanctions .The Russian state owned shipping group Sovcomflot with its tanker fleet is a key player in enabling oil exports to India and elsewhere after Western certifiers withdrew their services due to global sanctions against Moscow. This is bolstered by certification by the Indian Register of Shipping (IRC) , an internationally recognized classification company, completing the paper trail including the much needed insurance coverage required to maintain Sovcomflot’s tanker fleet afloat and continue delivering Russian crude oil to overseas markets. The IRC as per information available on its website has certified more than 80 ships managed by SCF Management Services (Dubai) Ltd, which not surprisingly turns out to be a UAE based entity listed as a subsidiary on Sovcomflot’s website. Russia would have to secure extra shadow tankers either by dipping into the second hand market, or by enticing shadow tankers away from other trades by paying a premium compared with Iran or Venezuela. Post invasion, Russia circumvented sanctions through hundreds of ageing tankers, snapped up by intermediaries, investors and anonymous traders .The cunning yet effective strategy enabled cargo flows to remain alive at a critical point in time for Russia. The old age of these investments enabled to bypass many of the sanctions on oil exports, including a $60-a-barrel price cap on Russian crude that was imposed by the Group of Seven.

Old Tonnage

Tankers are also spending more time in transit. The pool of buyers for Russian crude has shrunk since the war meaning cargoes that used to be hauled just a couple of days along the Baltic Sea now travel for weeks to get to China and India. These tankers and those transporting already to Venezuela and Iran counted up to 900. These are often without industry-standard insurance or unable to benefit from other Western services, and owners are not traceable. The average age of the fleet less than a year ago was 19 years, with ships that are near or over 20 usually destined for scrapping. There have been several clampdowns in Asia which were the likely catalysts for a shift in mentality around old tonnage along with several detentions over safety issues. Certain nations have set the right benchmarks on the matter including India which moved to ban vessels older than 25 years of age from entering its ports earlier this year,

and China, one of the top consumers of Russian and Iranian oil, which recently ramped up checks on older tankers at the key port of Qingdao forcing some to wait more than a month to unload. Singapore has also detained tankers for failing safety inspections in recent months This cumulatively may have pressured Russia serving ships to upgrade. The armada of the world’s oldest and most dangerous vessels is starting to get younger. It is estimated that discreet buyers have now brought down the average age to 15 years of age, detracting second hand supply from many other trades and boosting the chances of rates returning to the higher level.

Refining the art of evading sanctions

Iran is experienced and has developed mechanisms to evade sanctions by capitalizing on the geography of its territorial waters .Due to sanctions by US on Iran crude and chemicals enter the high seas then are transferred through ship to ship mode (STS) after the ship GIS/coordinates are disabled. The vessels then move to any Middle East port (usually Fujerah in U.A.E) obtain a Certificate of Origin and BL is issued for onwards destination to any port for discharging. Deliberate switching off of AIS transmitter is a violation of SOLAS . Iranian cargoes remain under US sanctions since the year 2000. Iran circumvents sanctions and maintains a certain level of crude exports. The geography of the Gulf depicts a unregulated labyrinths of production facilities , trading hubs, networks of oil refineries, storage tanks, production sites, and export terminals littering southeast Iraq and southwest Iran near the river that separates the two countries as well as the coastal region of Iraq’s al-Faw Peninsula which camouflages the origin of oil. Cargo ships and oil tankers (with crude stored ) are moored in anticipation of Iraqi and Iranian crude.

Iran’s Collaboration with UAE- Sanctions – Spoofing & FATF

Iran in collusion with U.A.E which is a global trading and transshipment hub for crude and refined petroleum products blends liquid cargo , changes vessel names and identification codes to obfuscate the identify of its oil tankers. The UAE coastline is hugged with Iran’s armada of 123 tankers registered in nations without the inclination to monitor tankers flying their flag. Iranian vessels are adept at ‘spoofing’ which is manipulating GPS software that reports a vessel’s position so it appears to be elsewhere when it docks undetected in prohibited areas for disguising an illicit transfer of liquid fuel in the region. The United Arab Emirates has recently entered the FATF ” Grey List ” making it a non-compliant jurisdiction.

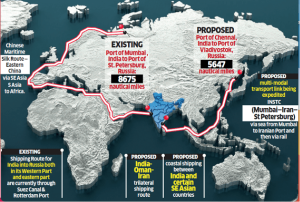

Russian route to transport crude to India

Russia’s Frozen Arctic Ocean – Inexorable Drive to Black Sea Warm Waters

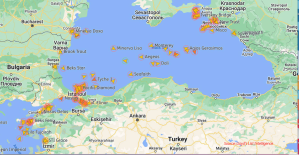

Most of Russia’s coast is in the Arctic Ocean which is frozen for most part of the year. The Russians have targeted the Southern Black Sea seaports of Ukraine namely Mariupol, Odessa and Beryansk. Inland waterways is being developed upto the coast. The Black sea coast has around 65 seaports and is a busy trade route. Constanta port of Romania is the largest Black Sea seaport . Russia has a warm water seaport here namely Port of Novorossiysk. Around 20 million tonnes of Petroleum products (3 million bpd) pass the Straits of Bosporus annually. In the year 2014 Russia annexed Crimea . The port of Sevastopol in Crimea , which housed most of Ukraine’s Navy , and had repair yards is now controlled by Russia and has become one of the regions biggest warm water ports uniquely placed between the Black Sea and the Sea of Azov. Crimea and the southern Russian port city of Novorossiysk provide the Russian navy and tankers with access to warm water ports .Ships entering or leaving the Black Sea must past through the Turkish-controlled straits of the Bosphorus and the Dardanelles, two strategically important passageways between the Black Sea and Mediterranean Seas. Around 38 % of maritime crude of Russia pass the straits. It is the primary route for oil exports from Kazakhstan and Azerbaijan as well. Ship to Ship transfer from Russian crude carriers are taking place off the Romanian coastline to ships under other flags which dock at ports in Greece. Transponders are turned off so Marinet cannot track them. The Strait of Kerch connects the Black Sea with the Azov Sea with the East and West side of the Strait of Kerch being under control of the Russian Navy. Ukraine maritime strength to enforce its territorial claims over the Sea of Azov and the Black Sea is compromised. The Montreux Convention of 1936 allows Turkey exclusive rights to decide which ships traverse through its two straits. Under this convention non – Black sea countries have limited access to passage between the straits.

Russia’s seaborne oil exports

Russia’s seaborne oil exports have increased from 3.394 million bpd on 28th February 2022 to 3.754 million bpd by 13th June 2022 an increase of 11% , despite trade sanctions. Russian crude transported vide sea are unloaded at India’s western ports and China is supplied Russian crude shipped from Russia’s Pacific coast . Logistic issues persist as there is a global shortage of ships which can act as ice breakers as most of the hydrocarbon is located in the Arctic and after the sanctions managing insurance is problematic but trade dynamics may alter this situation. Vessels voyages are longer when transporting Urals crude from Russia’s western ports to Asia rather than Europe as typically a journey to China may take around two months.

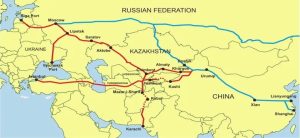

Oil Tankers not being allowed Transit through Turkish Waters – Insurance

Russia exports nearly 50% of its crude oil and refined products via long-distance pipelines with the balance through waterborne liftings and trade. It has the two longest oil pipelines in the world, the Druzhba to the west and ESPO oil pipeline in the East. However, there are commercial limitations to delivering incremental crude oil to the east via the ESPO oil pipeline. Russia and China market participants signed a long term oil supply contract in 2012 for an estimated annual volume of 15 MMt for the term of 20 years. In contrast to Russia’s lack of crude oil storage facilities , China has 12 SPR sites in operation totaling 249.7 mmbbl and is contemplating another 5. Russia does have an inherent advantage as besides these pipelines waterborne crude oil liftings via Very Large Crude Carriers , medium size Aframax tankers and other vessel sizes and types provide additional Russian crude oil disposition options. The fleet of tankers engaged in transporting sanctioned crude will exceed 400 vessels if Russian affiliated ships are added to the vessels known to be engaged in Iranian and Venezuelan trades according to an analysis by BRS. The shipbroker has identified 268 tankers of 34,000 dwt and above, including those in Iran’s National Iranian Tanker Co, as involved in the “illicit carriage of Iranian or Venezuelan oil over the past few years”. Russian tanker owners and operators cannot call at US or UK ports, while Russian-flagged ships are banned from European Union ports. Oil imports will be phased out in Europe and UK by the end of the year. If these tankers are used to load Russian crude and added to the so-called shadow or subterfuge fleet of tankers, there are 401 ships that account for 7.6 % of the global fleet by number and 9.4 % by deadweight as per a BRS report. There is also likely to be a tug of war between cargo interests in Venezuela and Iran with Russia for the estimated third-party owned 30 suezmax and 53 very large crude carriers in the subterfuge fleet Russia would have to secure as extra shadow tankers either by dipping into the second hand market, or by enticing shadow tankers away from other trades by paying a premium compared with Iran or Venezuela.

Imposition of Sanctions on Countries Trading with Russia

Sanctions are presently applicable to Russia and no secondary sanctions imposed on other countries. Sanctions are imposed as per US Presidential orders which need to be carefully interpreted. At present Russia is denied access to SWIFT/ international Western Banking channels and both China and India are circumventing this payment route by other means so Pakistan can examine legitimate mechanisms.

Payment Currency Mechanism for Russian Gas

In the year 2022 currency and payment provisions in GSAs came into the spotlight in the context of the Russian invasion of Ukraine and Russia’s demand for rouble gas payments formulated in a Decree published in March 2022. While several EU buyers accepted the new payment mechanism some other buyers’ refused to pay for gas in roubles which resulted in their supplies of Russian gas being cut off by Gazprom. In its current form the rouble gas payment mechanism is limited to pipeline gas supplies indicating a possibility of its expansion to Russian LNG sales. In a parallel development the application of rouble gas payments has expanded beyond the EU with Gazprom and China National Petroleum Corporation agreeing on payments for Russian gas delivered through a Russia China pipeline based on a 50-50 split between the rouble and yuan.

Saudi Suppliers Strategy for its Free Trade Zones

Refinitiv Eikon ship tracking shows Saudi Arabia imported 647,000 tonnes (48,000 barrels per day) of fuel oil from Russia via Russian and Estonian ports in April to June period this year. That was up from 320,000 tonnes in the same period in the year 2021. For the full year 2021 KSA imported 1.05 million tonnes of Russian fuel oil. Saudi Arabia has for several years imported Russian fuel oil, which can reduce its need to refine crude for products and cut the amount of oil it needs to burn for power in the hot summer months at its emerging and developing zones , leaving it with more unrefined crude to sell on international markets at higher prices. Some Saudi cities are far from natural gas fields that could provide cleaner fuel for power generation. The hub of oil trade Fujairah in U.A.E has received 1.17 million tonnes of Russian fuel oil in the year 2022 according to ship tracking compared with 0.9 million in the same period last year. An oil refinery in Sicily, owned by Russia’s second largest oil and gas giant Lukoil, acts as a pass-through for Russian crude, which ultimately makes its way to the U.S as gasoline and other refined oil products. There is a loophole in the US sanctions on Russia as banned Russian crude can be refined outside of Russia and shipped to the US.

Maritime Route for Pakistan -Role of National Flag Carrier

The Eastern maritime route suits Pakistan passing China and Straits of Malacca from Russian Ports of Valadivistok and Kozmino. The national flag carrier i.e Pakistan National Shipping Corporation (PNSC) may analyse the logistic costs and time involved in these routes vis-à-vis its existing oil routes from the Middle East especially as it has the ” First Right of Refusal ” . PNSC has 4 Oil Carriers which can be deployed on Russian route. PNSC can charter oil tankers as well. PNSC is bound to comply state directives to carry liquid fuel cargoes from Russian ports. In any case PNSC operates in a monopoly. As per public published accounts PNSC is earning around PKR 4 billion profit annually. Out of its 11 vessels 4 are crude carriers and 7 are chartered to other parties in other routes. So to ensure Energy Security it can lower or not even charge freight rates as it has a healthy balance sheet. Role of public sector in Pakistan traditionally was to support state initiatives , invest and open up the sector for the private sector investment which will only come when there is assured profit. So PNSC can go insolvent as long as energy and food security is met. National Insurance Corporation Limited being state controlled is mandated to provide insurance back up to PNSC .

Way forward to Secure Energy & Food Security – No direct Sanctions on Pakistan

It may be considered inking a Long term deal with Russia on Energy & Grain capitalizing on global situation which is likely to persist .On a Short to Medium Term the National Flag Carrier should transport Russian oil regardless of freight cost. Pakistan may engage on priority with Gazprom (Russian) to import LNG as there are no EU sanctions and Europe is directly importing LNG from Russia despite restricting gas flow through pipeline. Pakistan national flag carrier may emulate initiatives of Russian shipowner Sovcomflot which is exporting Russian LNG to Europe including Greece. Pakistan should appreciate the modern commercial energy warfare and import Russian oil through Estonian ports or import Russian oil from bunkering hub of oil trade Fujairah in U.A.E

LNG Spot Rates Rising in Ukrainian Crisis

Less availability of LNG carriers and soaring spot rates for LNG carriers are witnessed at the Baltic Exchange rates as high as $450,000 a day while Spark Commodities reports fixtures in the Atlantic at $425,000 prompting analysts to indicate half a million dollars a day mark could be reached by November 2022.The required LNG infrastructure and capacity would not be achieved till the year 2026 to have an alternative to Russian gas.

Regasification Terminals Capacity in Europe

The arrival of multiple cargoes of the superchilled fuel has exposed Europe’s lack of “regasification” capacity as plants that convert the seaborne fuel back to gas are operating at maximum limit.If the backlog is not cleared soon those ships may start looking for alternative ports outside Europe to offload their cargo. Floating storage levels in LNG shipping is at an all time high level with slightly more than 2.5 million tonnes tied up in floating storage. The shortage of regasification plants, or pipelines connecting countries that have those facilities to other European markets means that the LNG floating offshore cannot be used. In October, 2022 there were 35 LNG laden vessels drifting off Spain and around the Mediterranean, with at least eight vessels anchored off the Bay of Cadiz alone as Spain at one stage offered just six slots at its regasification terminals for cargoes (less than a fifth of the number of vessels queuing off its coasts). This is a typical case of entitled “declaration of exceptional operational situation” according to Spain’s national gas grid operator Enagas its position being that it may have to reject unloads of LNG due to overcapacity at its terminals.Such high occupation levels at the country’s regasification plants was expected to remain at least until the first week of November, 2022.

LNG from Russia

Russia is currently the world’s fourth largest supplier and exporter of LNG. Recently a cargo of LNG on LNG tanker Pskov (170,000 cbm) directly sailed with LNG cargo from the Gazprom LNG plant newly constructed 1.1 million tonnes per annum capacity from two trains situated off the now defunct Nord Stream 1 pipeline on Russia’s Baltic coast. The plant liquefies natural gas coming from the nearby Portovaya compressor station, part of Gazprom’s currently shuttered Nord Stream pipeline. The LNG cargo originated from the 138,107 cbm Portovyy, which serves as a floating storage unit for Gazprom’s LNG export project located near Russia’s Baltic Sea port of Vysotsk. German state owned Gazprom Germania redelivered to Russian shipowner Sovcomflot .There are no EU sanctions on Russian gas. There is a RePower EU plan that pledges going away from Russian gas but no specific immediate action against anyone purchasing it. European terminals are regularly receiving LNG shipments from Russia. If it were not for Russia itself limiting its flows via Ukraine and Nordstream (NS1) more gas would be imported. Russia is willing to send its gas via this long voyage to Europe when it could send spot gas via pipeline and rack up even more profits. Russia is raking up tax rates on its Sakhalin Island marine LNG terminals to compensate for EU imposing of price caps on hydrocarbon imports from Russia and Gazprom’s declining revenues fron gas export through pipelines to Europe. Energy warfare goes on it seems.

Russia US Sanctions Guidelines

The economics of energy markets is evident in the G 7’s plan to cap Russian oil income to prevent a price surge when an EU embargo of Russian oil imports and financial insurance service restrictions takes effect on 5th December 2022 . Some consider the price cap a waste of time because it can be easily circumvented as Russia can offset the impact of the G 7 cap by making buyers purchase “entitlements to export oil” from its central bank or another institution, which are not recorded on invoices. These transactions will negate any income losses from the price cap. The US Department of the Treasury issued ” preliminary guidance ” for the G 7 price cap which took effect on 5th December 2022 for maritime transportation of crude oil and on 5th Feb. 2022 for maritime transportation of petroleum products. Its three objectives are to maintain a reliable supply of seaborne Russian oil to the global market, reduce upward pressure on energy prices and reduce the revenues Russia earns from oil. The US Treasury document also details how the rules will be implemented, recordkeeping ,how those buying, transporting or insuring cargos can comply with the regulations .

US Treasury on the Lookout

The US Treasury guidance explicitly warns that it will be looking for efforts to evade its sanctions, such as “unusually favorable payment terms, inflated costs or insistence on using circuitous or opaque payment mechanisms.” It will also watch for “seaborne Russian oil purchased so far below the price cap as to be economically non-viable for the Russian exporter may be an indication that the purchaser has made a back-end arrangement to evade the price cap.” Similarly “excessively high services costs may be an indication that a service provider has made a back-end arrangement to evade the price cap” . The easiest way for Russia to circumvent the price cap would be to announce that buyers interested in Russian oil must purchase a license to do so from the central bank. The license price would reflect the difference between world oil prices and the Treasury’s ceiling price. Oil purchases by licensees would be invoiced at the ceiling price or even a discount from the ceiling price and through its licensing authority that Russia can outmaneuver US and wider G 7 efforts. The danger inherent in the price cap program is that imposing a ceiling price and threatening sanctions could push world oil prices rising as high as $150 per barrel.

Price Cap Policy -Loopholes

Bilateral trade between India and Russia hit a new high of $18.2 bn by value, from April through to August, 2022 versus $13.1 bn reported for the whole of previous fiscal . OFAC published its formal guidance on the price cap sanctions for Russian oil entering into force on December 5, 2022 .The price cap policy is intended to maintain a reliable supply of oil to the global markets while reducing the revenues the Russian Federation earns from its oil after the conflict in Ukraine inflated global energy prices.US services can provide covered services such as trading / commodities brokering, insurance and reinsurance, customs brokering, indemnity , financing and shipping as long as the Russian oil is purchased at or below the ” price cap “. The loophole which may be exploited is ” substantial transformation ” through refining or blending in Middle Eastern or Greek or other ports and issuance of blending certificates once the cargo of crude clears customs jurisdiction .

Waivers

If USA allows waiver from sanctions to a foreign flagged vessel then any country can similarly seek a waiver for fuel / grain import from Iran & Russia .Pakistan may engage on priority with Gazprom (Russia) to import LNG as no EU sanctions and Europe is directly importing LNG from Russia despite restricting gas flow through pipelines. Pakistan’s national flag carrier may consider emulating initiatives of Russian shipowner Sovcomflot which is exporting Russian LNG to Europe including Greece. As there is not enough corresponding regasification plants, or pipelines connecting countries that have those facilities to other European markets LNG floating offshore cannot be used and Pakistan can make a bid to divert such LNG cargos at spot. Pakistan needs to understand energy commercial and economic rapidly changing dynamics , international energy pricing and US Treasury guidelines for the G 7 price cap mechanism.

Authored by Nadir Mumtaz

https://en.wikipedia.org/wiki/Black_Sea

https://carnegieendowment.org/2021/05/20/what-is-russia-doing-in-black-sea-pub-84549

http://Russian Companies & Commercial Subterfuge

https://www.aljazeera.com/economy/2022/4/27/india-struggles-to-find-vessel-to-ship-crude-from-russia

https://www.linkedin.com/in/tanalbayrak/recent-activity/

https://www.energyintel.com/00000183-697c-d090-adeb-e97ced520000

https://www.middleeasteye.net/news/saudi-arabia-russian-oil-imports-double-discounted

Leave A Comment