Israel Haifa Port & US Maritime Concerns

India’s Adani Ports Group along with a Israeli logistics group acquired Israel’s premier Mediterranean Sea Port of Haifa .The Adani Ports conglomerate is expanding its portfolio in Israel and future plans include establishing of a trade and strategic gateway connecting the Port of Haifa and Middle Eastern region despite Israel not having diplomatic relations with the Kingdom of Saudi Arabia .The Port of Haifa was acquired by Adani Group at a cost of around $ 1.10 billion and India’s Adani Ports has 70 % stake in the acquisition.

India Intrudes into Israel Port Business

Adani Ports & Special Economic Zone Ltd in partnership with local chemicals and logistics group Gadot last year emerged successful in acquiring the Israel government’s tender for Haifa Port a major maritime and trade hub on Israel’s coast for a staggering $1.2 billion.Adani Group has paid the full amount now and is eying the significant real estate acreage and has grandiose plans to change the silhouette of the port cities. Perhaps from a trade strategic perspective the Indian entities acquisition of Israel’s Haifa Port may establish a trans-Mediterranean maritime link for India bypassing the Suez Canal and is expected that Haifa port would reduce the shipping time from Mumbai to Europe by almost 40%.

Source/credit X Haifa /Eurasian

Source/credit X Haifa /Eurasian

The Adani Group manages 13 sea terminals in India accounting for almost 24% of the maritime trade of India. Haifa Port is the first international acquisition for the Adani Group and is no mean feat. To its credit the Adani Group has also been co-producing Hermes 900 medium altitude and long endurance drones, Galil Sniper rifles, Negev light machine guns and Tavor X95 assault rifles in collaboration with Israeli companies as well as with the Israeli Innovation Authority, Israeli Weapons System and Elbit Systems. Plans are afoot to establish an artificial intelligence lab in Tel Aviv as well. It was revealed in the Hindenburg accusations that GQG Partners, an American asset management and investment company, had announced an investment of around $1.88 billion in four companies under Adani Trust, acquiring a 4.1% stake in Adani Ports amounting to $640 million.

China’s Acquiring of Stakes in Haifa Bayport Worrisome for USA

The Port of Haifa is an energy hub and produces and distributes petroleum products as a significant oil refinery is located here. The Port of Haifa thus operates on competitive terms with the Haifa Bayport owned by China’s Shanghai International Port Group with its 25-year management contract. A Chinese company also operates a cargo terminal in the Ashdod Port although not as active as the terminals in Haifa.

Diego Garcia US Military Air Base

The Indian Ocean sees one-third of the world’s bulk cargo traffic and two-thirds of the world’s oil shipments .The UK government succumbing to international pressure is ceding sovereignty of a remote but strategically important cluster of islands called Chagos Islands in the Indian Ocean to Mauritius after almost fifty years . In the year 2019 the UN General Assembly overwhelmingly backed a motion for the return of the island group by 116 votes to 6 and in the same year The International Court of Justice ruled that the UK’s sovereignty over the islands should end as quickly as possible. The Chagos Islands is an archipelago located in the Indian Ocean comprising 58 islands situated almost 500 km to the south of the Maldives archipelago in the Indian Ocean. The Chagos Islands include the tropical atoll of Diego Garcia an operational military base for its navy ships and long-range bomber aircraft. The UK leased Diego Garcia to the US in the year 1966 for 50 years and was rewarded by a $14m discount on sales of US Polaris nuclear armed submarine-launched ballistic missiles systems. The UK will however ensure operation of the military base for “an initial period” of 99 years. Mauritius and China have inked a Free Trade Pact in the year 2021 which indicates growing trade ties and is a cause of concern for US military strategists. Mauritius is expected to economically exploit the territory and grant fishing rights and other navigation rights to the waters surrounding the Diego Garcia base. Mauritius will have the inherent right to economically exploit the archipelago and develop infrastructure and China may launch its state owned entities to establish projects as vital reconnaissance staging areas if escalation takes place due to its aggressive posture in the waters near Taiwan. The Diego Garcia naval base hosts US long-range bombers and remains of considerable interest to China which may step up use of its fishing fleet, routinely equipped with sensors and communications equipment, to monitor US maritime activities.

Credit;ALJAZEERA

Credit;ALJAZEERA

China’s BRI and CPEC Attempted Countering through Indian Proxies

Credit/Source;Mexico Business News

Credit/Source;Mexico Business News

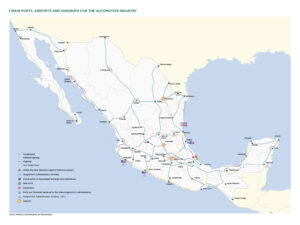

The operation of critical infrastructure by an Israeli company which in turn is owned by China is not being digested by the US. The United States grants about $4 billion in military aid to Israel each year and has taken exception to the Chinese maritime container facility in Haifa Bayport. The US has voiced its concerns about Chinese espionage as the US Sixth Fleet frequently visits Israeli ports and Israel’s main submarine base housing its nuclear submarines is nearby. In a bid to counter China’s infrastructure-driven, multifaceted Belt and Road Initiative (BRI) the acquisition by Adani Group of Haifa Port in a joint bid with Israeli company Gadot appears to be tacitly or at times overtly encouraged by the US. There is a maritime adage that ” appreciate the hinterland of any port and the port throughput will ensue “. The terminal operator DP World has understood the present Chinese corporate mind set as Chinese companies are pumping funds to develop manufacturing facilities in Mexico to circumvent U.S. tariffs likely to be imposed on Chinese origin products as evidenced by Chinese companies relentless surge in containerized imports loading at Northern Mexican ports .The containers arriving in increasing numbers from China are being processed for re-export to the U.S at Mexican ports located near the U.S. border as well on the direct railway lines and high capacity highways linking Mexico with the U.S. The Chinese origin products can be similarly shipped to Gwadar Port which is a transhipment port leased to China with an exclusive economic zone in existence. Of course it goes without saying that the concerned maritime and port policy makers need to develop a complete transportation logistics chain including the port(s) to inland ports/logistics centers-transports especially towards the US border . As a logistic insurance China has initiated the construction of a road to connect China to Iran through Afghanistan considered the expedient and swift route for China to buy oil from Iran and China is desirous to connect to Turkey through Iran. The Central Asian countries and China are poised to utilise Pakistan’s ports for trade . There is a possibility of Pakistan emerging as an exporter of sophisticated manufactured complex Chinese high value products . In the future the US which has a phobia of the Chinese economic juggernaut may combine with India to insidiously combat the China Pakistan Economic Corridor (CPEC) directly or through proxies especially at Pakistan’s three ports.

Credit;

Credit;

Cem Sinan GÜZEL,MA,LCB

Ports Geostrategic Location vs Commercial Expediency

Whenever trade is influenced by regional politics the concepts which lead to the establishment of massive transhipment hubs and ports are under constant economic and commercial review. When maritime politics drastically change and sea freight transportation hubs shift as origin of goods change so do established maritime alliances amongst the operators of the container ships and liners re – orient global shipping networks and routes as well as the composition of the national fleets. Pakistan’s national flag carrier Pakistan National Shipping Corporation (PNSC) remains oblivious to such global port and commercial maritime re positioning. Such fleet re-configurations also necessarily entail a review of port of calls. The ports are constantly revaluated to the extent of their productivity and efficiency and Green Index (environmentally friendly standards) as carrier visits and ensuing schedules may minimize port calls and instead concentrate towards sailing between ports.

Credit;EASTASIAFORUM

Credit;EASTASIAFORUM

In the eighties PNSC had at one time 66 vessels. In sharp contrast to PNSC the Bangladesh Shipping Corporation (BSC) embarked on its journey with 2 ships in 1972 and got listed in the stock market in 1977.In 2018 six new ships comprising 3 oil tankers and 3 bulk carriers were purchased. Around 80 feeder vessels transport containerised cargo between transshipment ports and Chattogram port, which handles 98 % of the country’s total containerised goods transport. In a smart commercial move BSC is set to purchase 6 modern container ships from South Korea at a cost of $330.32 million to smash the stranglehold of non-Bangladeshi feeder vessels which causes outflow of a substantial amount of foreign currency in freight costs. The state shipping corporation BSC also plans to purchase 6 more container ships following this project expanding its fleet to a total of 22 ships by 2030. The BSC would then be in a position to launch direct shipping to European destinations, significantly reducing both time and costs in foreign trade.

Transshipment business a Footloose Activity

Singapore’s prominence in global maritime shipping is attributable to its strategic location at the entrance to the Strait of Malacca and its economic stability enabled the growth of substantial port activity with over 95 % of traffic involving cargo transiting through, rather than being destined for, Singapore Port. In the year 1990, Singapore handled 5.2 million twenty-foot equivalent units, a volume that increased to 17 million TEU’s in 2000 and rose to 39 million twenty-foot equivalent units in 2023, making it the second busiest port in the world. The Port of Singapore Authority (PSA) is the world’s largest container terminal operator operating 60 terminals worldwide in 2024 and at one stage had the concession of Gwadar Port . Now PSA faces stiff competition from nearby transhipment hubs and ports like Tanjung Pelepas in Johor, Malaysia which has effectively competed and gained a share of the business as Transshipment business is a footloose activity driven by the decisions of carriers and terminal operators. The Red Sea crisis in 2023 marked a shift in container transshipment destined for Singapore. As ships got hijacked or damaged along the Red Sea route certain shipping lines opted to bypass , choosing the Cape Route around Africa despite the fact that the Suez Route between Shanghai and Western Europe takes about 27 sailing days and the Cape Route requires about 10 additional sailing days.

Authored by Nadir Mumtaz

Credit/Source ;

https://www.eurasiantimes.com/edited-india-controlling-israels-haifa-port-is-a-part-of-evolving/

https://www.eurasiantimes.com/edited-india-controlling-israels-haifa-port-is-a-part-of-evolving/

https://bharatshakti.in/haifa-port-acquisition-by-adani-group-challenges-remain/

https://www.linkedin.com/company/the-wall-street-journal/

https://www.bbc.com/news/articles/c98ynejg4l5o

https://www.aljazeera.com/news/2024/10/4/why-is-the-uk-handing-the-chagos-islands-back-to-mauritius

https://www.ft.com/content/eb0f14df-0758-48e6-a4d8-9e79f3cffb7c

https://foreignpolicy.com/2024/05/30/diego-garcia-us-uk-chagos-military-base/

https://eastasiaforum.org/2024/10/31/singapore-stuck-between-a-shipping-hub-and-a-hard-place/

https://www.thedailystar.net/business/news/bsc-buy-6-ships-330m-build-container-fleet-3832146

https://splash247.com/bangladesh-shipping-corporation-seeks-greater-government-support/

Leave A Comment