US Congressional Research Service

US sanctions on Iran already ban most U.S trade , block Iran government’s assets in the U.S. and prohibit U.S. foreign assistance and arms sales as per the Congressional Research Service . A large number of people and companies Iranian as well as foreign have been the subject of sanctions . Deviating from its earlier approach the US is currently persuading the European Union (EU) and other western allies to impose multilateral sanctions on Tehran as U.S. actions designated certain individuals ,entities , affiliates and subsidiaries linked to the ballistic missile production procuring on behalf of Iran’s defense industrial complex .US sanctions this month targeted 16 people and 2 entities linked to the production of Iranian unmanned aerial vehicles (UAV or drones) .

US Treasury Sanctions on Procurement Networks

The US State Department in a novel move levied travel restrictions on Iran’s Foreign Minister whenever he attends meetings at the United Nations in New York and also restricting the ministers movement to within a two-bloc radius of the UN headquarter district. On a broad plane the United States is imposing sanctions on procurement networks operating from Iran, Türkiye, Oman and Germany involved in obtaining arsenal for Iran’s Islamic Revolutionary Guard Corps, Aerospace Force Self Sufficiency Jihad Organization, Ministry of Defense and Armed Forces Logistics , Iran Centrifuge Technology Company and other U.S.-sanctioned entities comprising Iran’s military-industrial complex.

Legislation Tied to Ukraine & Taiwan

The United States intends to employ all its financial resources to expose and disrupt the networks it believes are supporting Iran’s proliferation of weapons with the motive of destabilising the Middle East and enabling Russia to remain engaged in the Black Sea conflict .

US Targeted Sanctions

Stringent new sanctions on Iranian crude passed the U.S. House of Representatives this month and will likely become law . Attached to the legislation is a package of aid for Ukraine, Israel and Taiwan. Whereas previous sanctions focused on Iranian vessels and exporters the amended rules aim for foreign refiners that procure the crude , in this case Chinese .The new sanctions aim for foreign bankers, shipowners and seaports facilitating illicit trade . The United States additionally imposed fresh sanctions on 16 individuals and 2 entities associated with Iran’s drone program .The individuals designated include executives of an engine manufacturer that supplies Iran’s Shahad-131 drones alongwith corporates which service engines of drones for Iranian proxy forces in the Middle East conflict . The US Treasury Department shared that it was penalising 5 companies associated with Iran’s steel industry and 3 subsidiaries of an Iranian automakers .

EU Role in Sanctions

Fresh sanctions actively involving the United States and its European allies aim to severe supplies to Iran’s missile and drone program and attempt to disrupt Iran’s military supply chain and its funding sources .The US is pressing into action the myriad of US Treasury’s economic and financial tools to degrade and disrupt Iran’s drone and missile fleet operational ability including its unmanned aerial vehicle program . Succumbing to US pressure the EU is actively considering a new sanctions package of its own.

Enforcement Regime of Sanctions & Oil Price

Sanctions take a toll if the enforcement regime is effective .The US has a disincentive to take a strict line as coming down hard on Iranian crude exports would reduce the global oil supply thereby increasing energy prices and encouraging inflationary tendencies. The legislation will enable the US administration to permit 180-day waivers at its discretion when it considers as “vital to the national interests of the United States.” In the context of permissive enforcement trends China’s independent refiners are likely to continue purchase of Iranian discount cargoes of crude imported ostensibly under the guise of Malaysian or United Emirates crude.

Sanctions Sinister China Clause

Credit ;Maritime Analytica

Credit ;Maritime Analytica

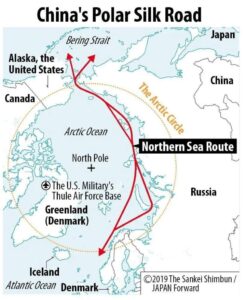

The terms ‘shadow fleet’, ‘dark fleet’ and ‘grey fleet’ have gained prominence following the imposition of sanctions on Russian energy exports basically by vessels lacking Western insurance and belonging to non-EU/G7+ companies. Russia employs diverse tactics to circumvent sanctions such as using of flags of convenience , intricate ownership and management structures , concealing origins of cargo through ship-to-ship transfers and automatic identification system blackouts or falsified positions and at times transmission of false data. Russia’s ‘shadow fleet’ mostly consists of a growing number of aging and poorly maintained vessels that operate with minimal regard to the regulations, posing significant environmental, maritime safety and security risks. As a reaction the European Parliament called for enhanced maritime surveillance, tighter shipping controls and expanded sanctions to address the significant environmental and safety threats posed by these vessels. The Northern Sea Route (NSR) is seen by China as a strategic maritime opportunity as Russia explores how to develop the NSR with India and China. The NSR is expected to reduce travel time between Asia and Europe by up to 14 days. China is desirous of developing its Silk Maritime Trade routes or China’s Polar Silk Route and accessing Arctic resources amid geopolitical challenges whereas India plans to enhance trade links with Russia to counter Chinese influence. Despite infrastructure gaps the NSR promises significant future opportunities. Again the G7 is in competition with BRICS countries especially China, UAE and Iran heavily dependent on the Taiwan Strait for exports (24%+).

China and Japan rely on the Strait for nearly a third of imports. The G7 nations, except Japan, have much lower dependence (under 10 %).

Tensions over Taiwan keep raising concerns of trade disruption which is reflective of China’s expanding control over key maritime trade routes.

China has invested in 129 global port projects, with 17 under control and its strategic investments include Sri Lanka, Pakistan and Tanzania as well as in Peru. China’s influence boosts trade growth in Southeast Asia and the Gulf under the Belt and Road investments which is expected to rebound in 2024.

The Bill which is soon to be an instrument of legislation includes specific measures imposing sanctions on ;

1)Foreign port owners or operators who allow sanctioned Iranian tankers to dock or transfer oil;

2)Shipowners or operators who engage in a Ship to Ship transfer

3) Refinery owners or operators who purchase or process Iranian oil

4) And family members

Any ships found involved in handling Iranian crude cargoes could be banned from berthing at American ports for 2 years which would serve as a potential deterrent to casual shipping lines or owners for ships touching ports in the United States of America. A separate clause would expand financial sanctions to Chinese banking institutions that facilitate Iranian crude trade .This time around the US is going beyond its jurisdiction for transactions outside the U.S. financial system. In a first the assessment of each China sponsored financial institution would be annual and time bound.

Venezuela Evades US Sanctions

In the meanwhile Iran’s continues to pump around 1.8 million bpd with most of it headed straight to China’s “teapot” refineries and this is managed through its ghost fleet tankers running stealth operations as the transponders are switched off . Iranian crude is conveniently rebranded as “Malaysian” or “Omani” as Iran loops its crude through Malaysia and UAE via ship-to-ship transfers. Despite US sanctions Venezuelan medium crude Type Blend 22

(22° API) made by blending Orinoco Belt extra-heavy oil with naphtha

is shipped to France’s Maurel & Prom in swap arrangements. Such new blended grades like Blend 22 translate into more diverse routes to Europe and Asia , longer voyages for the VLCC’s and fantastic profits for the liners.

Author Nadir Mumtaz

Credit/Sources;

https://ofac.treasury.gov/sanctions-programs-and-country-information/iran-sanctions

https://www.aljazeera.com/news/2024/4/18/us-imposes-new-sanctions-on-iran-after-attack-on-israel

https://www.reuters.com/world/what-are-us-sanctions-iran-how-can-washington-impose-more-2024-04-16/

https://edition.cnn.com/2024/04/18/politics/us-sanctions-iran/index.html

https://www.voronoiapp.com/economy/How-Much-Do-G7-and-BRICS-Countries-Rely-on-the-Taiwan-Strait–2802

https://www.orfonline.org/expert-speak/understanding-the-potential-of-the-northern-sea-route

https://www.europarl.europa.eu/RegData/etudes/BRIE/2024/766242/EPRS_BRI(2024)766242_EN.pdf

Leave A Comment