ABC of Taxation – Pushing citizens into Poverty

As per a recent World Bank report Pakistan had made significant strides in the fight against poverty when the country’s poverty rate plummeted from 64 % to 22 % yet the new poverty lines for Pakistan set at $4.20 / person/day up from $3.65 / person/day, affects 44.7 % of the population . An additional 13 million Pakistanis have been pushed into poverty in fiscal 2023-24. The International Monetary Fund has in November , 2025 released a ” Governance and Corruption Diagnostic Report ” at the request and support of the Government of Pakistan . The IMF report reveals persistent and widespread corruption risks embedded in a heavily state-dominated economy that operates with complex regulatory environments, weak institutional capacities, fragmented oversight, with ineffective and inconsistent accountability and constrained rule of law collectively constraining private sector development and public sector effectiveness.

Elitist Tax Exemption

An impediment to economic and social growth , employment generation and slow down in business activities can be attributed to a ” Host of Tax Exemptions and Concessions ” insidiously built into the tax statutes . The ” Hapless taxpayer ” and the population of 230 million , 45 % of which is living below the poverty level as per World Bank estimates (even if the global income levels have been raised by the World Bank ), continues to subsidise the inefficiency of public sector entities accompanied by financial mismanagement all of which contribute to raise the cost of doing business , making exports non -competitive and discouraging investment and promoting capital outflow to regional competing economies . Equity in taxation seems to have taken a backseat. The economy is over taxed and over documented as any foreign or local travel , energy and utilities ,salary payment, internet usage or phone or SIM ,bank and e commerce transactions ,credit card usage, owning a car or immovable property , functions in hotels, is all heavily taxed and documented . Entities including NHA, Metro , Steel Mills , PIA, Railways , capacity payments to Railways , dole out of almost PKR 600 billion to BISP annually, Special Economic Zones akin to ceding of financial sovereignty , are subsidised by the imposition of additional taxes on the hapless citizens . It is strange that seminars on acquiring foreign citizenship , foreign education and property abroad are openly held in public view and the Anti Money Laundering regime is not initiated by the relevant authorities . Shipping Agents are filing returns (u/s 143B of the Income Tax Ordinance, 2001) in place of the Ship Captains of the Vessels and in flagrant violation of law which attract the provisions of Anti Money Laundering regime. This flagrant violations is allowing the Shipping Agents to repatriate freight costs in foreign currency and in USD $ to foreign shipping lines , with impunity . The Central Bank has admitted recently that there are variations after media reports highlighted a trade gap of a figure of USD $ 30 billion .

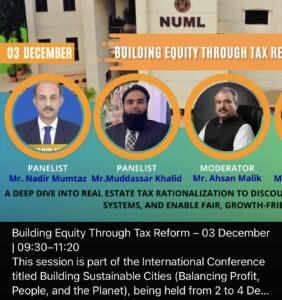

Credit;NUML

Salaried Class Groans under Heavy Taxation

The salaried class pays around PKR 400 billion as tax annually . Exports are to the tune of PKR 9 trillion and FBR tax collection is around PKR 9 trillion yet exporters pay tax to the tune of PKR 100 billion (on export proceeds realised in bank account) .From 1992 to the financial year 2024 commercial importers, contractors and exporters were immune from disclosing profits or opening their accounts to the tax authorities and were not taxed on actual profits.

Credit ;World Bank

Credit ;World Bank

High Taxation Structure

- Super Tax on High Earning Persons

- Rate on company including repatriation of dividends and Super tax goes upto 59 % .

- Tax on payments for Digital Transactions and e-commerce platforms

- Tax on Builders and developers

- Tax on Capital gains

- Sections 148 to 156 and sections 231A to 236Z of the Income Tax Ordinance, 2001 contain a plethora of advance tax provisions which are adjustable and refundable . Many of these provisions were introduced as transitional advance tax provisions to expand the tax base and instead have become a lever for generating revenues.

- Deemed section 7E , sub judice in superior courts , an amount equal to 5 % of the fair market value of capital assets situated in Pakistan

- Sections 42 to sections 54 , sections 148 (tax on imports) and the Second Schedule of Income Tax Ordinance, 2001 contain a host of tax exemptions and tax concessions . Section 42 (3) even makes pension received by a citizen from the UN and its specialised agencies exempt from tax. Any pension received by a person, being a citizen of Pakistan, by virtue of the person’s former employment in the United Nations or its specialised agencies (including the International Court of Justice) is exempt . Section 230J establishes an International Centre of Tax Excellence functions of which are to help contribute to the development of tax policy, prepare model national tax policy, deliver inter- disciplinary research in tax administration and policy, international tax cooperation, revenue forecasting, conduct international seminars, workshops and conferences on the current issues faced by tax authorities in the field of international taxation, capacity building of Inland Revenue Officers, tax analysis, improve the design and delivery of tax administration for maximising revenue within existing provisions to close the tax gap or any other function as directed by the Board or the Federal Government. There are many Directorates as well . However no prior rationale, studies or estimates published by the International Centre of Tax Excellence seem to be available in the public domain whenever any tax exemption or concession is granted to elitist persons.

- Section 53 provides that the Federal Government or the Federal Board of revenue may , pursuant to the approval of the Economic Coordination Committee of the Cabinet whenever circumstances exist to take immediate action for the purposes of national security, natural disaster, national food security in emergency situations, protection of national economic interests in situations arising out of abnormal fluctuation in international commodity prices, implementation of bilateral and multilateral agreements or granting an exemption from any tax imposed under this Ordinance including a reduction in the rate of tax imposed under this Ordinance or a reduction in tax liability under this Ordinance or an exemption from the operation of any provision of this Ordinance to any international financial institution or foreign Government owned financial institution operating under an agreement, memorandum of understanding or any other arrangement with the Government of Pakistan make such amendment in the Second Schedule.

- Incomes Exempt from Tax and Exemptions ,Tax Concessions , Exemptions from specific provisions of Income Tax as enumerated in Second Schedule to the Income Tax Ordinance, 2001 are highlighted below . These are only illustrative . Some exemptions are sector specific whereas others are entity specific. Allowing exemptions to economic zones in the past is akin to a loss of financial sovereignty and non application of Foreign Exchange Regulations meaning export proceeds are not realised in Pakistan .

Surprisingly, while an IMF report on elites corruption has been published , income of the employees and consultants of the IMF , World Bank , ADB , WHO , JICA and other external donor and development agencies is subjected to tax although no such exemption is specifically available in the tax statute. This is an illustrative , not an exhaustive list of exemptions available in the Tax law , shared below ;

Agha Khan Development Network

Saylani Welfare International Trust

Akhuwat

Audit Oversight Board

Habib University Foundation

Indus Hospital and Health Network

LUMS

Punjab Police Welfare Organization, Lahore

Federal Ziauddin University

Income of International Cricket Council (ICC) or employees, officials, agents and representatives of IBC and ICC, players, coaches, medical doctors and media representatives

Payments for services by way of operation of container or chemical or oil terminal at a sea-port in Pakistan

Income of the Islamic Development Bank wholly engaged in owning and leasing of tankers

China Overseas Ports Holding Company Limited, [Gawadar] International Terminal Limited, Gawadar] Port [and Gawadar Free Zone]] operations for a period of 23 years, contractors and sub-contractors of China Overseas Ports Holding Company Limited, for a period of 20 years

Profits of electric power generation project set up in Pakistan after 1988

Income which was not chargeable to tax prior to the commencement of the Constitution (Twenty-fifth Amendment) Act, 2018 (XXXVII of 2018) of any individual domiciled or company resident in the Tribal Area forming part of the Provinces of Khyber Pakhtunkhwa and Balochistan

LNG Terminal Operators and LNG Terminal Owners.

Payments of oil distribution company or an oil refinery for supply of petroleum products

Import of plant and equipment including dumpers for construction of Motorway project and Karakorum Highway(KKH) of CPEC project namely:- (a) M/s China State Construction EngineeringCorporation Ltd. (M/s CSCEC); and (b) M/s China Communication Construction Company (M/s CCCC).

M/s TAISEI Corporation under agreement btw NHA

To mitigate productivity gap, income tax exempted of experts provided that such expert is acquired with prior approval

Profits and gains derived by – zone developer as defined in the Special Technology Zones Authority Act,2021 (XVII of 2021) from development and operations of the zones for a period of 10 years

The provisions of section 148 (tax on imports) shall not apply on the import of goods which takes place within the jurisdiction of Border sustenance markets , subject to conditions of goods be supplied only within the limits of Border Sustenance Markets established in cooperation with Iran and Afghanistan

Coal Mining and Coal based Power Generation Projects in Sindh , despite the tariff of coal based electricity generation is one of the highest as per NePRA website

RANDOM SAMPLING / ANALYSIS of TAX PAID on INCOME/PROFITS by FERTILISER ,TOBACCO , TEXTILE , SUGAR & CEMENT SECTOR vs SALARIED CLASS

Average company tax rate is 39 % and in case profits are repatriated can go upto 59 % . While tax rates on the hapless taxpayers are rising when have fertiliser, tobacco , textile , sugar and cement companies financial statements been actually scrutinised by FBR /audit tax authorities ? The tax on income/profits paid by these sectors is apparently minuscule as a percentage of revenues/sales. FBR is placing excessive reliance on advance /witholding tax regime , refundable or adjustable largely, which unfortunately has resulted in a massive pile of debt on the treasury . No wonder FBR revenues are less then the previous year, as reported in the media. The consumer does not have the fiscal strength or capacity to pay more tax. The textile, cement, sugar , fertiliser and tobacco sectors earning the most should be the focus of financial scrutiny by FBR .The hapless salaried class pays direct/ income tax to the tune of Rs 400 billion annually ! Figures as per declared financial results below ;

PAKISTAN TOBACCO COMPANY PTC

Gross Turnover for 6 months (Jan to June 2025) = Rs 184 billion (b)

Net Turnover for 6 months (Jan to June 2025) = Rs 69 b

Gross Profit = 32

Operating Profit = 24

Profit after tax = 14 b

INCOME TAX worked out = 10 b

BESTWAY CEMENT – Year ended June 2024

Gross turnover – 145 billion

Gross profit – 32

Profit before tax – 22

Profit after tax – 13 b

INCOME TAX – 9 billion

HABIB SUGAR MILL Year 2024

Net Sales – 20 billion

Gross Profit – 2

Other income – 1.2

Operating profit – 2.7

INCOME TAX – 0.5 billion

GUL AHMED TEXTILE MILLS LIMITED AS ON JUNE 2024

Sales Exports – 143 billion

Gross Profit – 17

Operating profit – 12

Profit / (loss) before tax – 6 billion

Profit / (loss) after tax – 4.7 billion

INCOME TAX – 1 billion

FATIMA FERTLIZER Year 2024

Sales. – 238 billion

Gross Profit – 87

Profit / (loss) before tax – 60 billion

Profit / (loss) after tax – 34 billion

INCOME TAX – 25 billion

INTERLOOP

Interloop is the largest listed textile company on Pakistan Stock Exchange by market capitalization . Its Revenue by FY 2026 = USD $ 700 million and Customers include NIKE , ADDIDAS , HUGO ,M&S and LEVIS.

Annual net sales = PKR 156 billion

Profit before tax = PKR 17 billion

Profit after tax = PKR 15 billion

Income tax = PKR 2 billion

By Nadir Mumtaz

Trademark Blue Economy IPO-PK

Source /Credit;

( Fatima Fertiliser Annual Report website ), (PTC website)

, (Habib Sugar Mill website), ( Gul Ahmed Textile Mills Limited Annual Report website ), (Interloop website), (Bestway website). (Figures rounded to billion for convenience

https://tribune.com.pk/story/2571787/30b-gap-found-in-import-records

https://www.bestway.com.pk/wp-content/uploads/2024/08/Annual-Report-2024.pdf

https://www.ptc.com.pk/en/investors-and-reporting/investor-information/financial-information

https://gulahmed.com/wp/wp-content/uploads/2024/10/Annual_report_2024.pdf

https://www.habibsugar.com/pdfs/Accounts/Annual/2024.pdf

https://www.fatima-group.com/wp-content/uploads/2024/10/Fatima-3rd-Quarterly-Report-2024.pdf

https://dps.psx.com.pk/download/document/238254.pdf

Leave A Comment